Tax efficiencies

Understanding how to structure your property investments tax-efficiently can significantly boost your returns. This guide introduces key strategies used by seasoned investors to reduce liabilities, maximise allowable deductions, and protect long-term gains.

Whether you’re just starting out or scaling your portfolio, these insights will help you keep more of what you earn—legally and strategically.

Tax efficiencies

Understanding how to structure your property investments tax-efficiently can significantly boost your returns. This guide introduces key strategies used by seasoned investors to reduce liabilities, maximise allowable deductions, and protect long-term gains.

Whether you’re just starting out or scaling your portfolio, these insights will help you keep more of what you earn—legally and strategically.

Tax & VAT Guide (2025)

Confused about how tax and VAT affect your property investments?

This free guide breaks down the key considerations for investing in UK residential and commercial property via a limited company — helping you plan smarter, stay compliant, and protect your profits.

Tax & VAT Guide (2025)

Confused about how tax and VAT affect your property investments?

This free guide breaks down the key considerations for investing in UK residential and commercial property via a limited company — helping you plan smarter, stay compliant, and protect your profits.

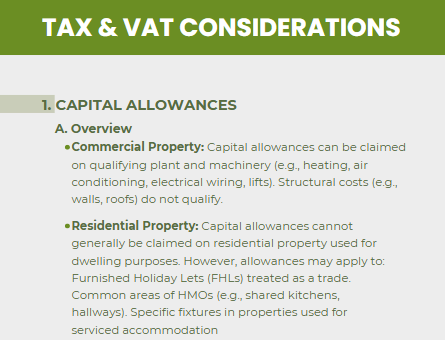

Understanding what you can and can’t claim is key to reducing your property tax bill. This section breaks down capital allowances for commercial and residential property investments in the UK—crucial knowledge for landlords, serviced accommodation operators, and limited company investors.

Looking to scale your portfolio without triggering unnecessary taxes? This section explains how commercial property investors can avoid Additional Stamp Duty, and what residential investors need to know about SDLT surcharges and the Annual Tax on Enveloped Dwellings (ATED) when investing via a limited company.

Overseas investors face a 2% SDLT surcharge on UK residential property—but not on commercial assets. This section outlines the exact tax implications for non-UK residents, helping international buyers minimise exposure and invest smarter through the right structure.

Ready to Build Wealth Through Property?

Start Your Investing Journey Today and unlock expert strategies, high-yield opportunities, and step-by-step guidance tailored for new investors.

Ready to Build Wealth Through Property?

Start Your Investing Journey Today and unlock expert strategies, high-yield opportunities, and step-by-step guidance tailored for new investors.

Newsletter Sign Up

Stay ahead with the latest investment opportunities and market insights.

Newsletter Sign Up

Stay ahead with the latest investment opportunities and market insights.