EXIT PLANNING & SUPPORT

This essential guide is designed for property investors looking to maximise tax efficiencies and secure their portfolios. It covers key strategies for transferring personal properties into a company structure, unlocking tax reliefs, and protecting assets from inheritance tax (IHT) using legacy trusts.

With insights on corporate tax advantages, asset protection, and exit pathways, this guide is a must-have for investors seeking to optimise their tax planning and future-proof their investments.

EXIT PLANNING & SUPPORT

This essential guide is designed for property investors looking to maximise tax efficiencies and secure their portfolios. It covers key strategies for transferring personal properties into a company structure, unlocking tax reliefs, and protecting assets from inheritance tax (IHT) using legacy trusts.

With insights on corporate tax advantages, asset protection, and exit pathways, this guide is a must-have for investors seeking to optimise their tax planning and future-proof their investments.

Tax & Exit Planning Insights

Exit Smart, Not Just Fast. Planning your exit is just as important as your entry.

This guide helps UK property investors structure tax-efficient exits, reduce capital gains exposure, and future-proof profits through strategic planning. Ideal for those investing via limited companies or building long-term portfolios.

Tax & Exit Planning Insights

Exit Smart, Not Just Fast. Planning your exit is just as important as your entry.

This guide helps UK property investors structure tax-efficient exits, reduce capital gains exposure, and future-proof profits through strategic planning. Ideal for those investing via limited companies or building long-term portfolios.

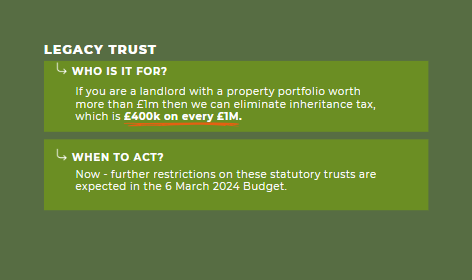

Own a property portfolio worth over £1M? This section explores how landlords can eliminate up to £400k in inheritance tax per £1M using legacy trusts—while there’s still time before further legislative changes take effect.

Discover how to legally minimise Capital Gains Tax and Stamp Duty when moving properties into a company. This section covers debasing under Corporation Tax Act S162 and LLP strategies for Stamp Duty relief—essential knowledge for serious UK property investors.

Ready to Build Wealth Through Property?

Start Your Investing Journey Today and unlock expert strategies, high-yield opportunities, and step-by-step guidance tailored for new investors.

Ready to Build Wealth Through Property?

Start Your Investing Journey Today and unlock expert strategies, high-yield opportunities, and step-by-step guidance tailored for new investors.

Newsletter Sign Up

Stay ahead with the latest investment opportunities and market insights.

Newsletter Sign Up

Stay ahead with the latest investment opportunities and market insights.